How to Help Mitigate the Negative Impacts of Market Swings

Review how to better prepare your portfolio for a downturn – and how to potentially take advantage of one when it occurs.

Market volatility is an inevitable part of investing. And it’s understandable that tumultuous times will likely trigger emotional responses to match.

But it’s important to remember to take a deep breath, focus on your long-term financial plan, and consult with a trusted professional – one who has seen an unpredictable market or two and the subsequent recoveries.

Proactively diversify

Your first defense against volatility is crafting and maintaining a balanced portfolio. Effective asset allocation and diversification can broaden your reach in the market and provide a potentially wider safety net during periods of turbulence.

Volatility often affects individual sectors and asset classes differently, so diversifying across various classes, sectors, and securities reduces the chance of one narrow decline devastating your overall portfolio. Additionally, paying attention to how your assets are correlated – how much they tend to move in the same direction – may help insulate your returns from the negative effects of volatility.

While diversification and asset allocation don’t assure a profit or protect against loss in declining markets, they do provide the opportunity to reduce risk, temper volatility and enhance risk-adjusted returns.

Remember:

- Your advisor can help you determine your long-term risk tolerance.

- Balanced portfolios may help reduce overall risk.

- Diversification may smooth ups and downs to help ease stress.

- Diversify across asset classes, sectors and securities.

- A broad portfolio offers the potential of better risk-adjusted returns.

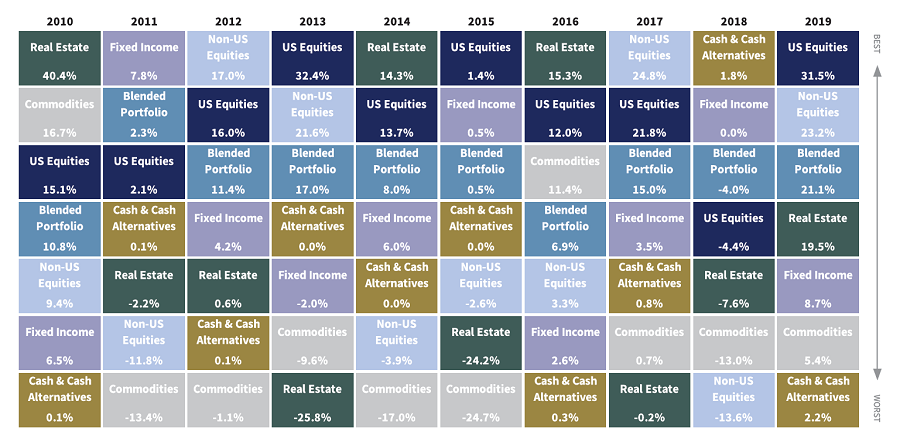

The best-performing asset class often changes from year to year, and the difference between the best- and worst-performing in any year can be significant. Here’s a look at how major asset classes performed compared to a diversified, blended portfolio in each of the last 10 years.

Blended Portfolio consists of 45% U.S. Equity, 15% Non-U.S. Equity and 40% U.S. Fixed Income. Source: FactSet and Raymond James Research. Returns are cumulative total return for stated period, including reinvestment of dividends. Past performance may not be indicative of future results. This analysis does not include transaction costs, which would reduce an investor’s return.

Look for strategic opportunities

Market volatility isn’t always bad news. Though it may be tempting to concentrate on losses caused by price fluctuations, it’s important to remember that volatility – and changing price trends – may offer opportunity for gains.

One way to potentially use volatility to your advantage is through dollar-cost averaging, the practice of investing a set amount every month or quarter. Although engaging the strategy takes discipline – you’ll be putting money into the market when the headlines (and likely your friends and colleagues) are full of doom and gloom – price declines often afford investors the opportunity to purchase assets at better valuations. In fact, you may be practicing one form of dollar-cost averaging already by making regular contributions to a company 401(k) plan, perhaps biweekly or monthly.

It’s also good to keep in mind that, in the right situation, selling assets at a loss, a practice called tax loss harvesting, may prove beneficial. This strategy can help offset the taxes on your investment gains. At the same time, you free up capital to reinvest at lower prices.

Focus on the long-term

Finally, don’t underestimate the value and importance of time. The markets have proven remarkably resilient over the long term. In fact, while the financial markets can be quite volatile year-to-year, historically returns have been generally positive over multi-year periods. By simply staying invested, you may give your assets the chance to rebound in the wake of downturns.

Source: Morningstar. Growth of $10,000 in the S&P 500 (1/31/40 - 4/2/20). Past performance may not be indicative of future results. This analysis does not include transaction costs, which would reduce an investor’s return. The S&P 500 is an unmanaged index of 500 widely held stocks. An investment cannot be made directly in this index.

Though it may be difficult, staying true to a personalized, long-term financial plan can help you ultimately achieve your objectives. Your financial advisor can serve as a trusted guide, addressing any concerns and helping you make progress toward your goals.

Read the full Weathering Market Volatility brochure

Investing involves risk including the possible loss of capital. Dollar cost averaging does not assure a profit and does not protect against loss. It involves continuous investment regardless of fluctuating price levels of such securities. Investors should consider their financial ability to continue purchases through periods of low price levels.

This article is provided in partnership with Bristol Wealth Group and Raymond James.